Picture source: Instagram ( Akasa Air )

India: The DGCA’s domestic traffic report for November 2024 gives a comprehensive overview of the performance of scheduled airlines in India, covering key metrics like passenger growth, load factors, cancellations, market share, complaints, regulatory compliance, on-time performance, and compensation.

Passenger Growth

Total Passengers (Jan-Nov 2024): 1464.02 lakhs

Total Passengers (Jan-Nov 2023): 1382.34 lakhs

Annual Growth Rate: 5.91%

Monthly Growth Rate (November 2024): 11.90%

The data shows a robust demand in the domestic aviation sector, with a significant increase in passenger traffic compared to the same period last year.

Passenger Load Factor

Alliance Air: 74.3%

Air India: 87.3%

Akasa Air: 90.3%

Indigo: 88.0%

SpiceJet: 35.6%

Vistara: 82.9%

Fly Big: 73.4%

Indiaone Air: 73.8%

Akasa Air and Indigo have demonstrated strong load factors, reflecting efficient capacity usage, while SpiceJet’s performance suggests room for improvement in filling available seats.

Cancellations

Overall Cancellation Rate (November 2024): 1.25%

The primary reasons for cancellations were weather-related (33.4%), followed by operational issues (23%) and technical problems (13.3%).

Airlines with the highest cancellation rates:

Fly Big: 36.71%

Alliance Air: 4.23%

Air India: 1.37%

Vistara: 1.59%

Market Share of Scheduled Domestic Airlines

Indigo: 90.70 lakhs (63.6%)

Air India: 34.73 lakhs (24.4%)

Akasa Air: 6.74 lakhs (4.7%)

SpiceJet: 4.43 lakhs (3.1%)

Alliance Air: 0.97 lakhs (0.7%)

Vistara: 4.15 lakhs (2.9%)

Indigo continues to dominate the domestic market, followed by Air India and Akasa Air. Other airlines are striving to expand their market presence.

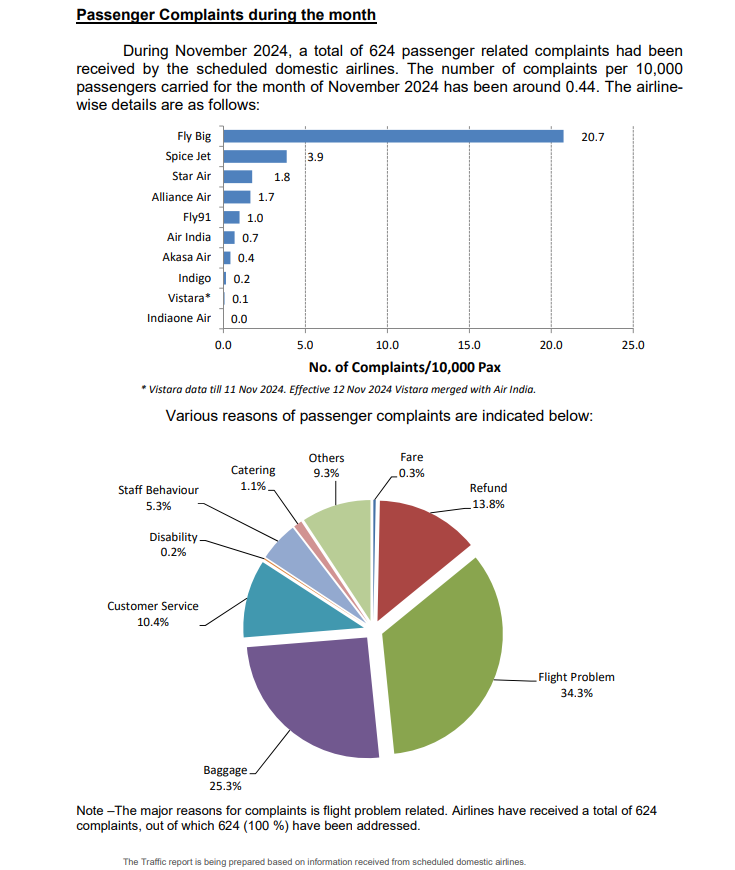

Passenger Complaints

DGCA November Report

Total Complaints (Nov 2024): 624

Complaints per 10,000 Passengers: 0.44

The main causes of complaints:

Flight Issues: 34.3%

Baggage Problems: 25.3%

Refund Issues: 13.8%

All complaints were resolved, reflecting the airlines’ commitment to customer service.

Compliance with Route Dispersal Guidelines

Alliance Air: 25085.8%

Air India: 111.5%

Akasa Air: 66.2%

Indigo: 186.1%

SpiceJet: 114.0%

Vistara: 44.0%

Alliance Air stands out for its high level of compliance with the government’s route dispersal guidelines.

On-Time Performance (OTP)

For November 2024, OTP at key metro airports—Bangalore, Delhi, Hyderabad, and Mumbai—was as follows:

Indigo: 74.5%

Akasa Air: 66.4%

SpiceJet: 62.5%

Air India: 58.8%

Alliance Air: 58.9%

Indigo and Vistara demonstrated the best on-time performance, underlining their operational efficiency, while Air India and Alliance Air lagged behind.

Revenue and Seats Sold in the Highest Fare Bucket

DGCA’s November Report

The report indicates that airlines are continuing to balance low-cost and premium pricing strategies to optimize revenue from high-fare buckets across major routes.

Denied Boarding, Cancellations, and Delays

Denied Boarding: 3,539 passengers affected; Compensation: Rs. 284.09 lakhs

Cancellations: 27,577 passengers affected; Compensation: Rs. 36.79 lakhs

Delays: 224,904 passengers affected; Compensation: Rs. 289.89 lakhs

Summary of Complaints and Redressal

Airlines effectively addressed all complaints:

Air India: 239 complaints

Indigo: 151 complaints

SpiceJet: 171 complaints

Vistara: 3 complaints

All complaints were successfully resolved, showcasing airlines’ dedication to customer care.

The November 2024 study shows a bright future for India’s domestic aviation sector. Strong passenger growth, great load factors, and a dedication to resolving consumer problems indicate a strong sector. Although cancellations and delays continue to be an issue, the airlines’ emphasis on improving efficiency and customer happiness implies that the industry is on the rise.

For the full and detailed report, check the official DGCA report here

Follow Aviation Today for more such news and updates!